Our Investment Process

A methodical approach to Malaysian stock investments

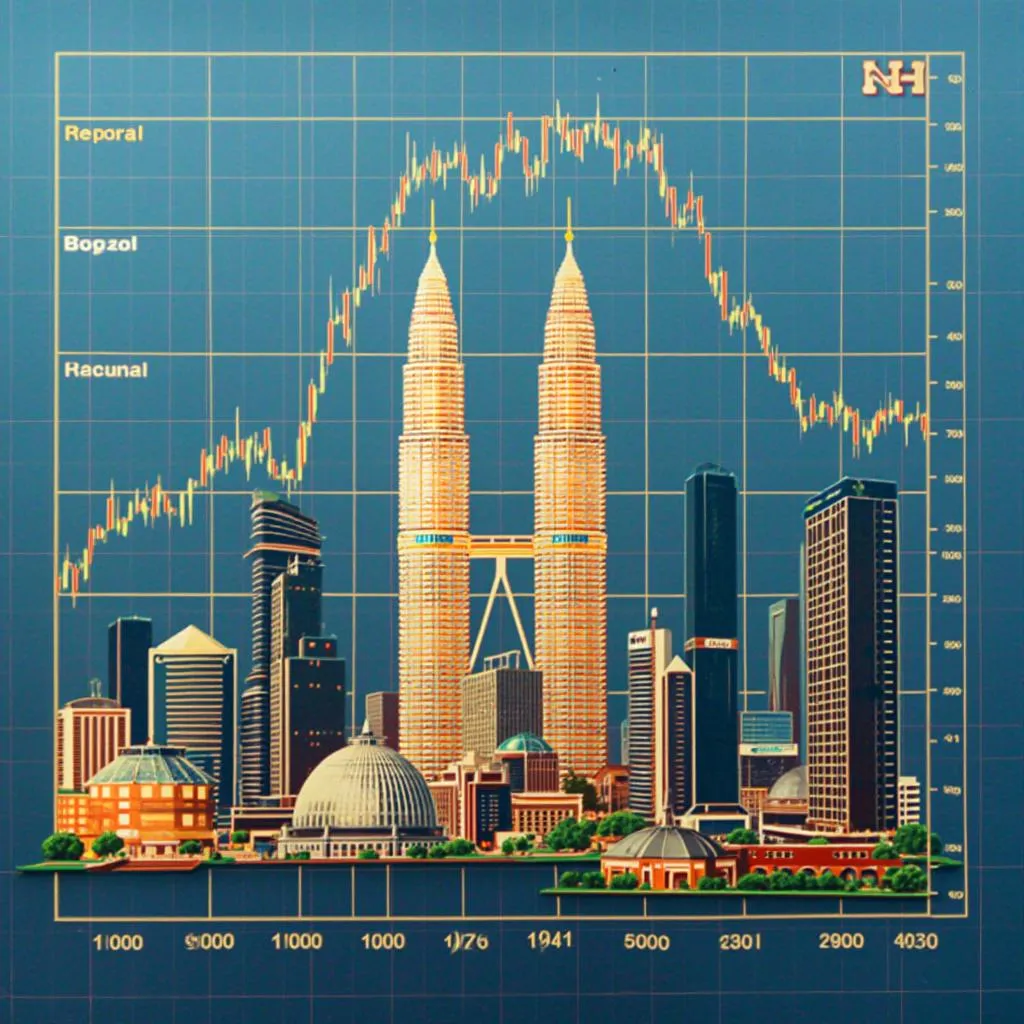

Market Analysis

Our investment journey begins with comprehensive market analysis of the Bursa Malaysia (formerly known as Kuala Lumpur Stock Exchange). We evaluate macroeconomic factors, industry trends, and market sentiment that influence Malaysian stocks. This foundational step includes studying historical performance patterns, analyzing current market conditions, and forecasting potential future movements. Our team of analysts meticulously examines economic indicators specific to Malaysia's unique market landscape to identify optimal entry points for investments.

Stock Selection

After market analysis, we employ a rigorous stock selection process focusing on Malaysian companies with strong fundamentals. We evaluate financial health, competitive advantages, management quality, and growth potential of businesses listed on Bursa Malaysia. Our approach combines value investing principles with growth considerations, prioritizing companies with sustainable business models. We pay special attention to Malaysia's economic pillars such as palm oil, electronics manufacturing, energy, and financial services, identifying companies poised for long-term success in these sectors.

Portfolio Construction

Portfolio construction involves strategically allocating investments across various Malaysian market sectors to optimize returns while managing risk. We create diversified portfolios that balance exposure to established Malaysian blue chips like Maybank and Petronas with emerging growth opportunities. Each portfolio is tailored to individual investment goals, time horizons, and risk tolerances. We implement asset allocation strategies that consider Malaysia's unique economic environment, including its sensitivity to regional economic trends and commodity prices, particularly in the palm oil and energy sectors.

Risk Management

Effective risk management is crucial when investing in Malaysian stocks. We implement sophisticated risk mitigation strategies including position sizing, stop-loss protocols, and correlation analysis to protect capital. Our approach accounts for Malaysia-specific risks such as currency fluctuations of the Malaysian Ringgit, political developments, and regulatory changes affecting the Bursa Malaysia. We continuously monitor portfolio volatility and implement hedging strategies when necessary. This disciplined risk management framework helps preserve capital during market downturns while maintaining exposure to Malaysia's growth potential.

Performance Monitoring

We implement continuous performance monitoring of Malaysian stock investments against benchmark indices like the FTSE Bursa Malaysia KLCI. Our analytical framework tracks both absolute returns and risk-adjusted performance metrics. Regular portfolio reviews assess individual holdings' contributions to overall performance. This ongoing monitoring process enables us to identify underperforming investments and capitalize on emerging opportunities in the Malaysian market. We provide transparent reporting that helps investors understand their portfolio's performance in the context of broader Malaysian market movements.

Portfolio Rebalancing

The final step in our process involves strategic portfolio rebalancing to maintain optimal asset allocation in response to changing Malaysian market conditions. We conduct periodic reviews to realign portfolios with investment objectives and risk parameters. This disciplined rebalancing approach prevents portfolio drift and maintains intended exposure to various Malaysian market sectors. Our tax-efficient rebalancing strategies consider Malaysia's capital gains tax implications, timing adjustments to minimize tax impacts while maximizing returns. This systematic approach ensures portfolios remain aligned with long-term investment goals while adapting to evolving market dynamics.